What Is a Bad Trading Strategy?

If you want a good one, just ask me.

So What is a Good Strategy?…

If you have questions about AMICODE service, start asking them now.

What Is a Bad Trading Strategy?

Knowing how to spot a bad strategy is just as important as knowing how to spot a good one. I'll help you with that.

Unfortunately, it won't be hard to find bad strategies... but if you want a good one, just ask me.

If you liked this article, you might like this one.

And how to avoid falling into one without realizing it

Everyone talks about what makes a good system.

But almost no one tells you what a bad system looks like.

And that's exactly what you should learn first.

Before you can trade well, you need to stop trading badly.

And that starts by recognizing what doesn’t make sense.

Here’s how to spot a bad system — even if it looks polished on the outside.

1. Unnecessarily Complex

Too many rules, too many filters, too many indicators.

It looks “professional,” but there’s no clear idea behind it — just noise.

The more you read it, the less sense it makes.

If you can’t explain what it does in a single sentence, you’re probably overcomplicating something simple.

2. Patching Mistakes With More Rules

Every time it fails, you add another condition.

Then another. And another.

That’s not how you build a system. That’s how you hide flaws.

Eventually, you can’t even tell what part is working and what’s just decoration.

3. No Real Market Logic

There’s no real pattern behind it. Just a mix of signals that “worked in the past.”

But you don’t know what the system is trying to exploit — or why it should keep working tomorrow.

A system with no logic is just an empty formula.

4. Looks Great in Backtests Only

It performs perfectly in historical data. But in live trading? It breaks.

Why?

Because it’s overfitted.

Optimized to look good in hindsight, but unable to adapt to anything real.

5. Impossible to Explain

If you can’t say out loud, in 30 seconds, what your system does and why — you don’t have a system.

You have something someone coded, but you don’t really understand.

And if you don’t understand it, you won’t execute it properly.

6. Inconsistent in Practice

Sometimes it signals a trade. Sometimes it doesn’t.

One day it enters. The next, you have no idea why it didn’t.

That’s not a system. That’s technical-looking uncertainty.

7. Creates Doubt Instead of Confidence

A good system gives you peace of mind.

You know when to enter. You know why. You know when to do nothing.

A system that makes you second-guess everything isn’t reliable.

And if it doesn’t let you trade with clarity, it’s useless.

So? That’s what a bad system looks like.

And even if many look sophisticated on the surface, if they don’t have structure, logic, and clarity — they’re just wasting your time.

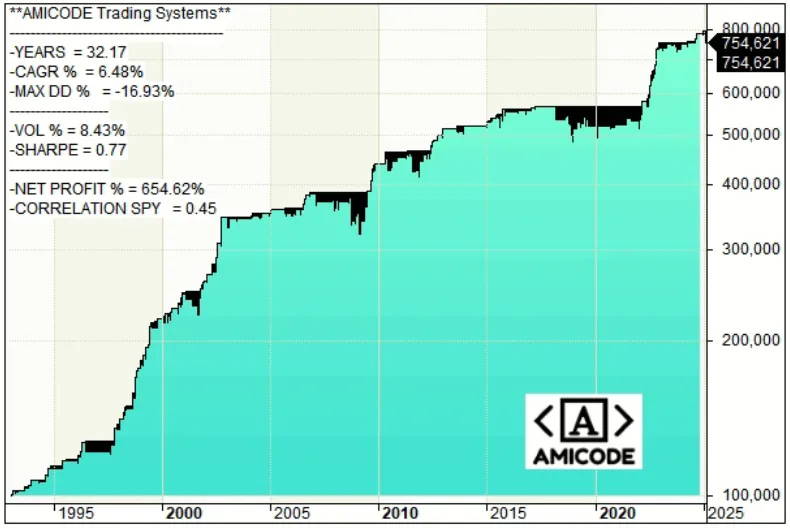

****** Want to see what a good Trading Strategy looks like?

Just ask, and I’ll send you one.

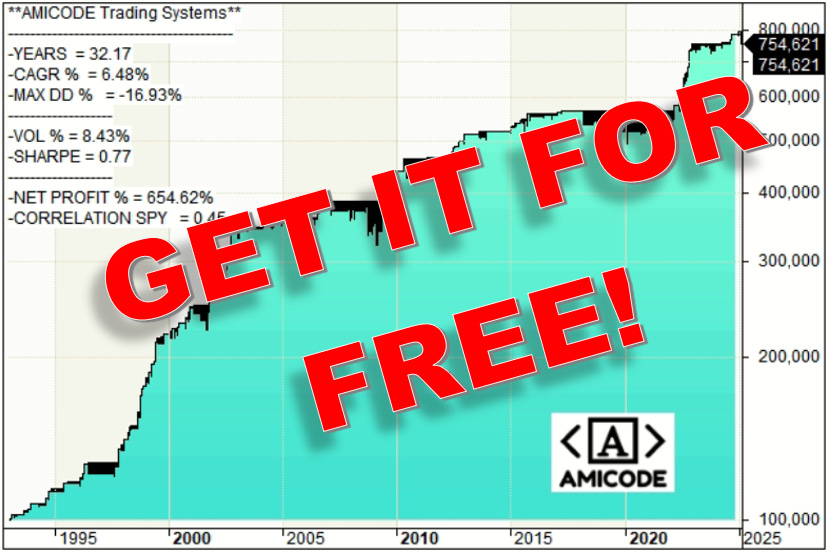

Do you want a Free AMICODE Trading Strategy?

Would you like to know what AMICODE Trading Strategies are like?

Disclaimer:

The content provided is for informational purposes only and should not be construed as financial advice. All information is provided "as is" with no representations or warranties, express or implied. The opinions expressed here are based solely on personal research and experience. Investing in the financial markets involves risks, including possible loss of principal. The systems provided on this website are made for educational and research purposes only, may contain errors and we make no guarantee of their accuracy. It is recommended not to trade these systems. We urge our readers to do their own research or consult with a qualified financial professional before making any investment decisions.

If you like our work, please share and give a like to get more. Thank you very much!