How To Build a Robust Trading System: A Step-by-Step Guide. Part 2

A Step-by-Step Guide to Build a Robust Trading System

How To Build a Robust Trading System: A Step-by-Step Guide. Part 2

If you haven't read the first part, you can find it below.

Creating a reliable trading system is critical to long-term success. In this second part of the guide, we will continue to explain how to design a solid trading framework, covering everything from goal setting to advanced testing techniques, all of which will help you manage risks effectively and increase profitability. Let’s continue!

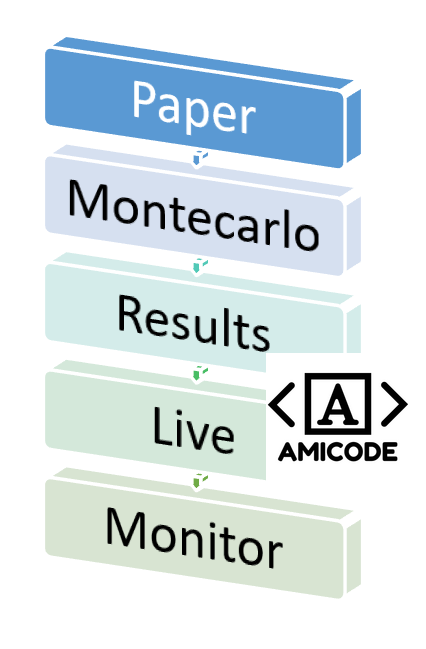

Step 7: Simulate with Paper Trading

Before committing real money, use paper trading to simulate live trading conditions. This allows you to see how your strategy performs in real-time without risking actual capital. It’s an excellent way to refine your system further.

Step 8: Use Monte Carlo Simulations

Monte Carlo analysis helps to assess the risk and uncertainty inherent in your strategy. By running thousands of simulations with random market conditions, you can gauge how the strategy might perform in various scenarios, preparing you for potential drawdowns.

Step 9: Review Results Thoroughly

After backtesting and advanced analyses, review your system’s overall performance. Metrics like win rate, drawdowns, and profit factor will help you assess if the system meets your trading goals and if any further adjustments are necessary.

Step 10: Go Live with Caution

Once you’re confident in your system’s performance, start trading with real capital, but begin with a smaller position size to minimize risk. As you gain more confidence in the strategy, gradually increase the scale of your trades.

Step 11: Monitor Performance Closely

Even after going live, it’s essential to monitor your strategy’s performance continuously. Compare live results with those from backtesting and paper trading to ensure the system is behaving as expected. Regular monitoring allows for timely adjustments if needed.

It is just as important to trade a trading strategy that works as it is to stop trading it when it stops working.

Conclusion

Designing a robust trading system requires a thoughtful, methodical approach. From defining clear goals to implementing advanced techniques like walkforward analysis and Monte Carlo simulations, each step is essential to the long-term success of your system. A well-designed strategy not only helps you navigate market volatility but also gives you the confidence to trade consistently and profitably. Keep refining your system, remain adaptable, and remember that successful trading is a continuous learning process.

By following these steps, you'll be well-prepared to create a trading system that stands the test of time and market fluctuations.

If you like our work, please share and give a like to get more. Thank you very much!