Amibroker's Backtesting Metrics: A Comprehensive Guide for Traders

Understanding your system metrics well is the key

Amibroker's Backtesting Metrics: A Comprehensive Guide for Traders

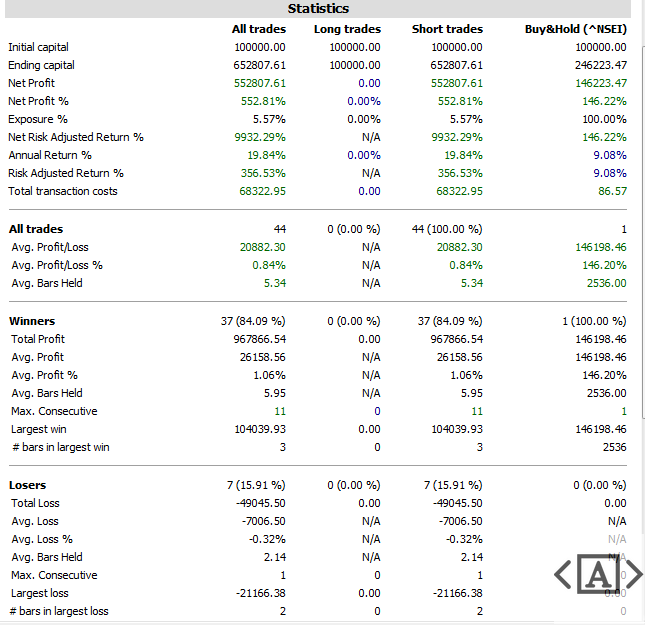

Welcome to a deep dive into Amibroker’s rich array of backtesting metrics, designed to optimize and validate your trading strategies. Understanding these metrics is essential for refining your approach and ensuring your strategy withstands the complexities of the market.

Understanding Exposure and Returns

Exposure %: Measures the trading system's market exposure on a bar-by-bar basis, calculated as the sum of bar exposures divided by the total number of bars.

Net Risk Adjusted Return %: This is your net profit percentage adjusted for the level of market exposure.

Annual Return % (CAR): The compounded annual return provides a snapshot of your strategy’s effectiveness over a year.

Risk Adjusted Return %: It refines the annual return by accounting for market exposure, offering a clearer view of performance.

Delving into Trade Dynamics

Average Profit/Loss ($ and %): Known as expectancy, these metrics provide an expected gain or loss per trade, blending the outcomes of winning and losing trades.

Maximum Trade Drawdowns: These crucial metrics track the deepest losses in a trade, emphasizing risk management.

Risk and Recovery Insights

System Drawdown (Absolute and %): These metrics monitor the largest declines across the entire portfolio, vital for assessing overall strategy risk.

Recovery Factor and CAR/MaxDD: Indicators of how well a strategy recovers from lows and its efficiency relative to drawdowns.

Advanced Statistical Measures

Profit Factor and Payoff Ratio: These ratios compare the wins to the losses, providing insight into the profitability of the strategy.

Standard Error and Risk-Reward Ratio: Measure the volatility of returns and the potential gain relative to the risk.

Ulcer Index and Performance: Assess the impact and recovery from drawdowns relative to baseline profitability.

Sharpe Ratio and K-Ratio: Offer insights into the risk-adjusted returns and the consistency of the strategy’s performance.

Understanding your system metrics well is the key

By integrating these metrics into your trading analysis, you can not only gauge the current effectiveness of your strategies but also make informed decisions to enhance future performance. Dive into these metrics, understand their implications, and harness them to craft robust trading strategies ready to face the dynamic market conditions.

By mastering these metrics provided by Amibroker’s backtesting reports, you're equipped to fine-tune your strategies with precision, anticipating and mitigating risks before they manifest in live trading.

This comprehensive understanding empowers you to navigate through market volatilities with a robust toolkit, optimizing your trading approach based on quantitative insights that dictate both short-term outcomes and long-term gains. Use these metrics not just to evaluate, but also to predict and shape the future trajectory of your trading endeavors, ensuring your strategies are not only responsive but also proactive in achieving sustainable profitability.