How To Build a Robust Trading System: A Step-by-Step Guide. Part 1

A Step-by-Step Guide to Build a Robust Trading System

How To Build a Robust Trading System: A Step-by-Step Guide. Part 1

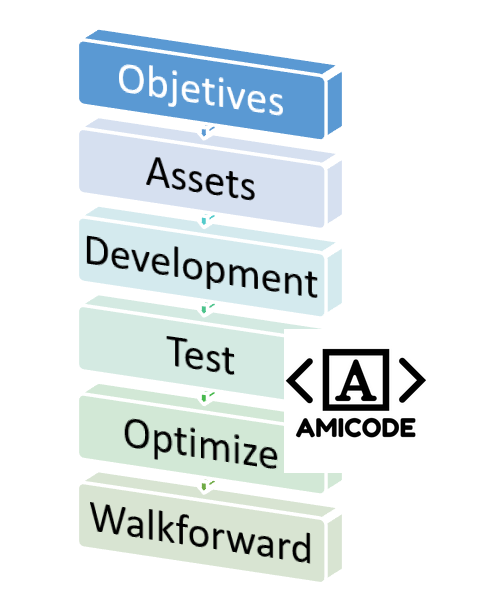

Creating a reliable trading system is fundamental to long-term trading success. In this guide, we’ll walk you through designing a solid trading framework, covering everything from goal-setting to advanced testing techniques, all of which will help you manage risks effectively and boost profitability.

Step 1: Set Clear Trading Objectives

First, it’s crucial to establish SMART goals—Specific, Measurable, Attainable, Relevant, and Time-bound. These objectives should align with what you hope to achieve, whether that’s maximizing returns, protecting capital, or generating steady income. These benchmarks will inform your system’s structure and strategy.

Step 2: Choose the Right Assets

Next, identify the assets you’ll be trading—stocks, forex, commodities, or cryptocurrencies. Each asset class has distinct risks and characteristics, so your choice should reflect both your goals and risk tolerance. For example, cryptocurrencies are known for their volatility, while blue-chip stocks tend to be more stable.

Step 3: Develop Your Strategy

Your trading system needs a clear set of rules for entering and exiting trades. This could involve technical analysis using indicators like moving averages, or fundamental analysis focusing on economic data. A good system strikes a balance between exploiting market inefficiencies and being simple enough to execute consistently.

Step 4: Test Your Strategy

Before risking real capital, backtest your strategy using historical data across several different markets and regimes to see how it would have performed under real market conditions. Backtesting helps to identify flaws and assess the potential risks and rewards of your system. Platforms like Amibroker provide useful tools for accurate backtesting.

Step 5: Optimize

After backtesting, fine-tune your strategy. This involves modifying the parameters that accompany your indicators within parameter ranges to ensure that you are not choosing the best, but one that works well against small variations.

However, avoid over-optimization, which can create a strategy that only works under historical conditions but fails in real markets. The strategy should work for most parameters; otherwise, discard it.

Step 6: Walkforward Analysis

Walkforward analysis is a powerful technique that ensures your system remains adaptive over time. This approach involves optimizing parameters over different time frames and then testing them out-of-sample. It helps ensure your strategy can adjust to ever-changing market conditions.

To be continue….

If you like our work, please share and give a like to get part 2. Thank you very much!

Can you do multiple WFA with Amibroker?