Trading platforms: Amibroker vs Tradingview

Many of you ask me this question, here is the answer.

Amibroker vs Tradingview

In the world of quantitative trading, where decisions are based on rigorous statistical testing and verifiable performance metrics, your choice of platform is not a convenience—it's a strategic asset. Many beginner traders are initially drawn to TradingView for its clean interface and visual appeal, but those who approach trading as a data-driven discipline soon realize that its capabilities are shallow and superficial.

By contrast, AmiBroker is a platform engineered from the ground up for professional technical analysis and quantitative system development. It offers unparalleled analytical depth, full control over data and strategy parameters, and a powerful environment to build, test, and refine trading systems with statistical precision.

In this article, we’ll compare both platforms strictly from the perspective that matters to a system trader: the ability to analyze, measure, and validate strategies with scientific accuracy. And in that comparison, AmiBroker dominates without contest.

1. Two Opposing Philosophies: Appearance vs. Analytical Depth

TradingView is a browser-based, cloud platform designed for visual charting, ease of use, and social interaction. It’s a great tool for casual traders, chart watchers, and beginners looking to get a feel for the markets.

But in quantitative analysis, simplicity quickly becomes a limitation. TradingView lacks robust testing tools, offers no serious statistical output, and doesn’t give users real control over data. It’s a graphical toy, not an analytical workbench.

AmiBroker, on the other hand, is a Windows-based application built for high-performance analytics. It’s not designed to entertain—it’s designed to empower traders who rely on logic, evidence, and performance metrics to build real trading systems. It’s a scientific toolkit, not a social app.

2. Programming Language: AFL vs. Pine Script

Quantitative analysis lives and dies by code. Without the right programming framework, it's impossible to express complex trading logic, perform rigorous data analysis, or model realistic market behavior.

AFL (AmiBroker Formula Language) is a vectorized, purpose-built language for financial time series. It supports advanced logical structures, multi-timeframe analysis, portfolio-level modeling, dynamic conditions, and custom statistical functions. It allows users to build, test, and optimize strategies of any complexity.

Pine Script (TradingView), while beginner-friendly, is severely limited in scope. It’s mostly useful for visual indicators and simple logic. It lacks robust data structures, advanced flow control, and real support for multi-asset or portfolio-level strategies.

Put simply: AFL is a quantitative research tool. Pine Script is a scripting language for hobbyists.

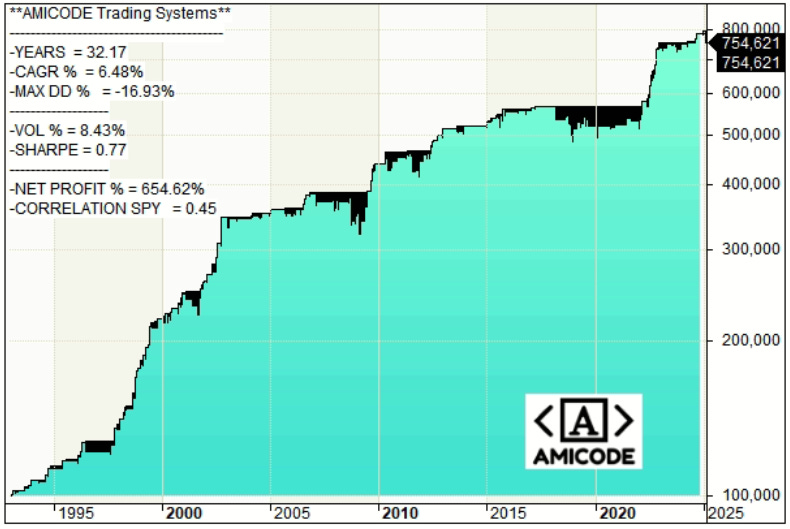

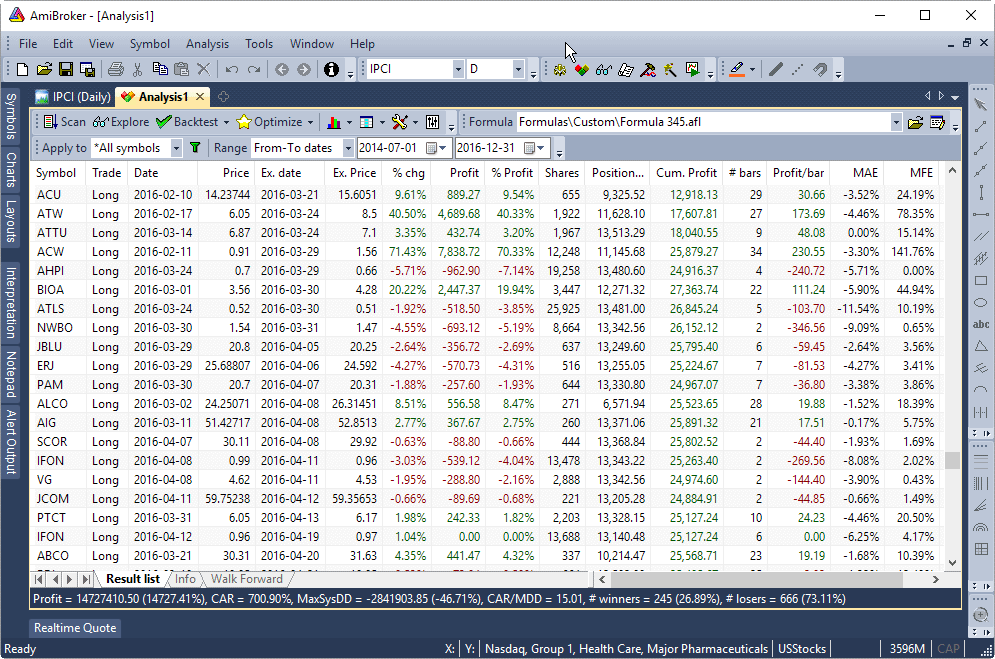

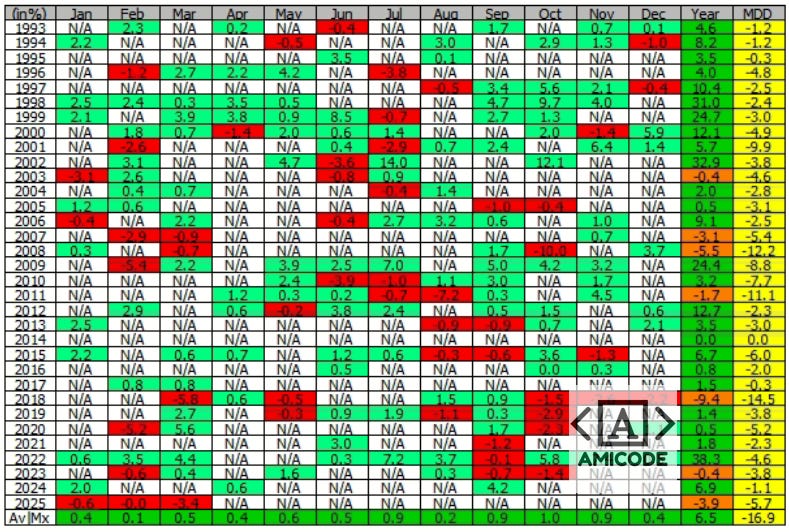

3. Backtesting and Professional Metrics: The Core of Quantitative Trading

Backtesting is the backbone of system trading. A good strategy isn't just "tested"; it's stress-tested, statistically dissected, and validated across various conditions. This requires performance metrics that go far beyond win rate and net profit.

AmiBroker delivers on this with one of the fastest and most precise backtesting engines in the industry. It allows:

Multi-symbol and multi-timeframe simulations

Realistic trade execution with commissions and slippage

Custom position sizing and dynamic logic

Full control over test intervals and out-of-sample data

But what truly sets it apart is its suite of professional-grade metrics, such as:

Expected value per trade

CAR/MDD (Compound Annual Return over Maximum Drawdown)

Ulcer index, recovery factor, and drawdown duration

Volatility-adjusted returns

Strategy robustness under stress conditions

These are not surface-level stats. They allow deep insight into the behavior, risk profile, and robustness of a trading system.

TradingView, in contrast, offers only basic performance outputs: net profit, win rate, number of trades. It does not simulate realistic execution conditions and doesn’t support portfolio-level testing. From a quantitative perspective, it’s practically useless.

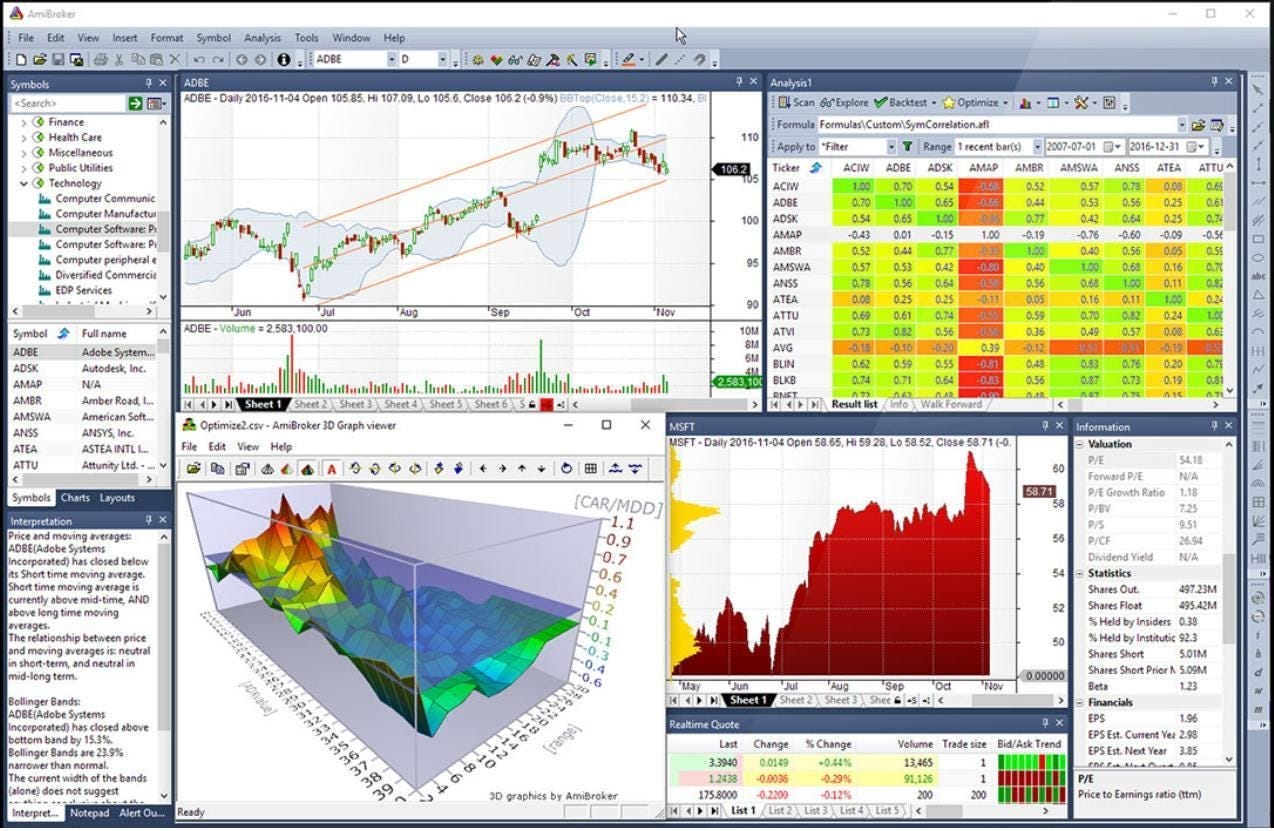

4. Advanced Optimization: Science, Not Guesswork

Robust strategies aren’t the result of luck—they’re the result of smart, controlled optimization. A platform without reliable optimization capabilities cannot support quantitative development.

AmiBroker includes a powerful, multi-threaded optimizer that lets you:

Explore millions of parameter combinations in seconds

Optimize for multiple objectives (e.g. max CAR, min drawdown)

Run walk-forward analysis and out-of-sample validation

Analyze parameter sensitivity and performance stability

This is critical for developing strategies that are not just profitable, but also stable, reliable, and resilient in live markets.

TradingView has no real optimization engine. You must change parameters manually and re-run visual backtests—a process that is slow, inefficient, and statistically invalid. There is no way to test for robustness, overfitting, or parameter decay.

5. Data Control and Quality: The Foundation of Quantitative Testing

In system trading, data quality determines the accuracy of your conclusions. Poor or incomplete data leads to false positives and misleading backtests.

AmiBroker gives you full control over data sources. You can connect to professional feeds, import custom CSVs, or build your own historical datasets. This includes:

Full control over data frequency and granularity

Ability to clean, align, and validate data

Use of external factors like macroeconomic or fundamental indicators

This means you design the data environment around your strategy, not the other way around.

TradingView offers fixed data from its providers with limited history and no import options. You cannot clean or validate the data, and you’re restricted to what they allow. For a quantitative trader, this eliminates any chance of serious research.

6. Conclusion: TradingView Is a Toy—AmiBroker Is a Scientific Tool

TradingView has its place. It’s great for beginners, visual thinkers, and those who want a social experience tied to charting. But let’s be clear: it is not a quantitative analysis platform.

AmiBroker, by contrast, is purpose-built for traders who want to model, test, and refine real strategies. Its combination of speed, precision, customization, and statistical depth make it the undisputed leader for professional system development.

If you're serious about building trading systems that are driven by logic, validated with evidence, and optimized for performance, there is no comparison. In 2025, as in years past, AmiBroker is the platform for serious quantitative traders.

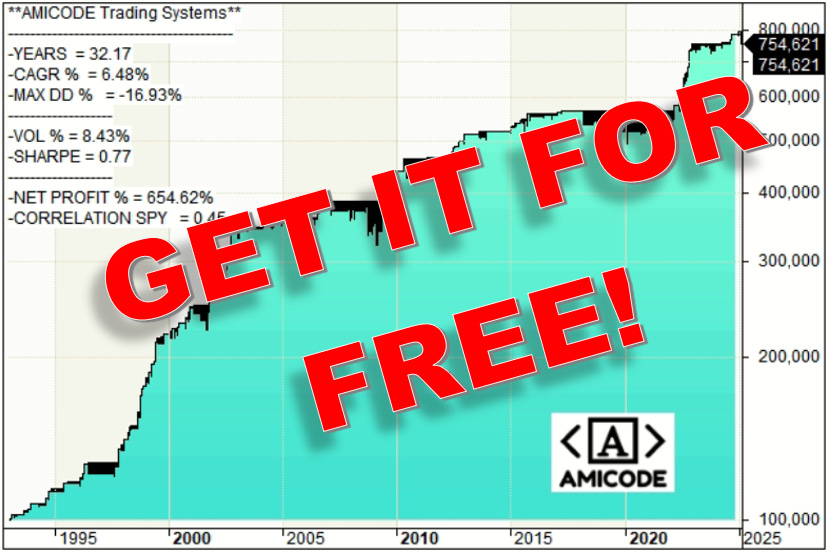

Do you want a Free AMICODE Trading Strategy?

Would you like to know what AMICODE Trading Strategies are like?