Amibroker 3: Optimization & Validation in AmiBroker

Why should you use Amibroker?

Optimization & Validation in AmiBroker

Key Features For Optimization & Validation in AmiBroker

AmiBroker offers advanced features for optimizing and validating trading systems to ensure robust performance.

True Portfolio-Level Optimization: Fully integrates portfolio backtester features and finds the best-performing parameter combinations using a user-defined objective function.

Exhaustive or Smart Optimization: Choose between exhaustive full-grid searches or AI-driven algorithms like PSO and CMA-ES, supporting up to 100 parameters for optimization. Additionally, users can create custom algorithms with the Optimizer API.

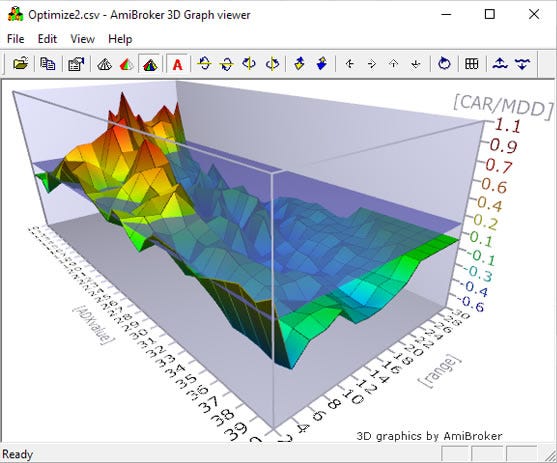

Speed & Visualization: AmiBroker’s optimizer is extremely fast, processing exhaustive optimizations in seconds. The results are visualized in 3D charts, making robustness analysis clear and intuitive

.

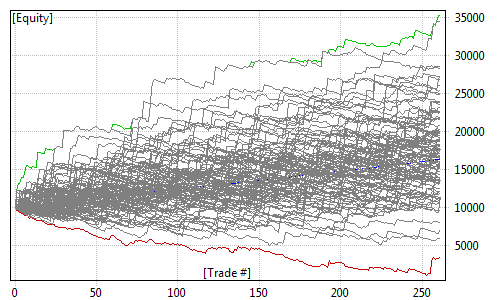

Monte Carlo Simulation: This feature allows users to prepare for tough market conditions by evaluating worst-case scenarios and calculating the probability of ruin, offering deep statistical insights into a system’s performance under uncertainty.

Robustness Testing: Randomization tools help test the stability of a system by simulating random stock picks, random trade pricing, and extreme market scenarios (e.g., flash crashes), ensuring strategies can withstand market unpredictability.

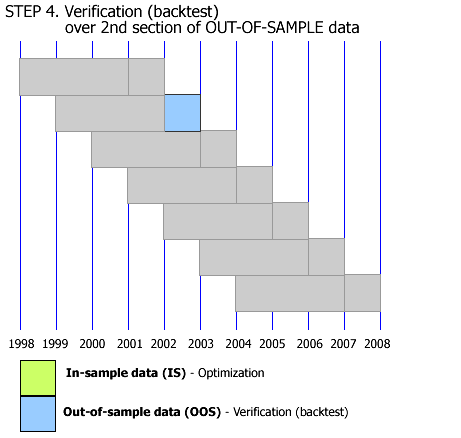

Walk-Forward Testing: This procedure ensures a strategy is not overfitted to historical data. Walk-forward testing continuously re-optimizes on one portion of the data and tests on out-of-sample periods, providing realistic performance assessments. AmiBroker’s fully automated walk-forward testing includes customizable start, end, and step intervals, along with user-defined objective functions. The results are presented in detailed reports, combining in-sample and out-of-sample statistics to help traders make informed decisions

.

These advanced optimization and validation tools make AmiBroker an industry-leading platform for developing robust and reliable trading systems.