The 7 Most Common Backtesting Mistakes and How to Avoid Them

How to Avoid Them

So what is a good strategy?…

If you have questions about AMICODE service, start asking them now.

The 7 Most Common Backtesting Mistakes and How to Avoid Them

If you liked this article, you might like this one.

Backtesting is a fundamental tool for any trader looking to validate a strategy before risking real money. Testing a system against historical data allows you to evaluate its behavior under various market conditions, helping you make more informed decisions. However, the process is not foolproof—there are several common mistakes that can lead to misleading results. In this article, we’ll break down the 7 most frequent backtesting errors and how to steer clear of them effectively.

1. Overfitting the System

Overfitting is one of the most dangerous mistakes in system development. It happens when a strategy is tailored too closely to historical data, making it unable to adapt to future market behavior. The system may look flawless in hindsight but fail miserably in live conditions.

This typically occurs when too many parameters or rules are used, fine-tuning the system to capture even the smallest market fluctuations from the past. These patterns often don’t repeat, making the system rigid and ineffective in new scenarios.

How to avoid it:

Keep your strategy as simple as possible.

Base your rules on solid, well-established market principles.

Use cross-validation or walk-forward analysis to test out-of-sample robustness.

2. Using Unreliable or Inadequate Data

The quality of the historical data used in backtesting is crucial. Working with incomplete, inaccurate, or low-context data can completely distort your analysis. Another key aspect is the nature of the asset itself—backtesting a strategy on highly liquid assets like the EUR/USD or S&P 500 is vastly different from testing on illiquid or thinly traded instruments.

A strategy that appears profitable on an asset with low trading volume may fall apart in real trading due to liquidity issues.

How to avoid it:

Always use data from reliable sources.

Assess the liquidity level of the asset before drawing conclusions.

Avoid backtesting on assets with short trading histories or low market participation unless you have a specific reason to do so.

3. Hindsight Bias: Evaluating the Chart with Future Knowledge

One of the most common cognitive biases in backtesting is hindsight bias. This happens when traders analyze historical charts and assume that entry and exit points were obvious—because they already know what happened next.

This creates a false sense of confidence in the strategy’s effectiveness, even though those decisions wouldn’t have been so clear in real-time conditions.

How to avoid it:

Step through the backtest one bar at a time, without viewing the entire chart in advance.

Use tools that simulate real-time flow, letting you test sequentially.

Automate decisions to remove subjective judgment.

If you liked this article, you might like this one.

4. Ignoring Market Liquidity

Failing to consider liquidity is another major backtesting oversight. Traders often assume their trades will execute smoothly, without considering whether the market actually allows for that in practice. This is especially relevant when dealing with low-volume instruments like some ETFs, small-cap stocks, or lesser-known cryptocurrencies.

Liquidity impacts both trade execution and the realism of your backtest. Strategies that rely on fast entries or exits may be unfeasible if there isn’t enough volume to support your trades.

How to avoid it:

Analyze the average daily volume of the asset you plan to trade.

Use highly liquid assets for fast-paced or high-frequency strategies.

If trading illiquid assets, design your system to be less dependent on quick execution.

5. Not Using a Separate Validation Period

Evaluating a system only on the same dataset used to develop it is a common but misleading practice. It gives the illusion of performance, as the system has already been tailored to fit that specific data.

To truly assess a strategy’s potential, it must be tested on a different data segment that played no role in the system’s design.

How to avoid it:

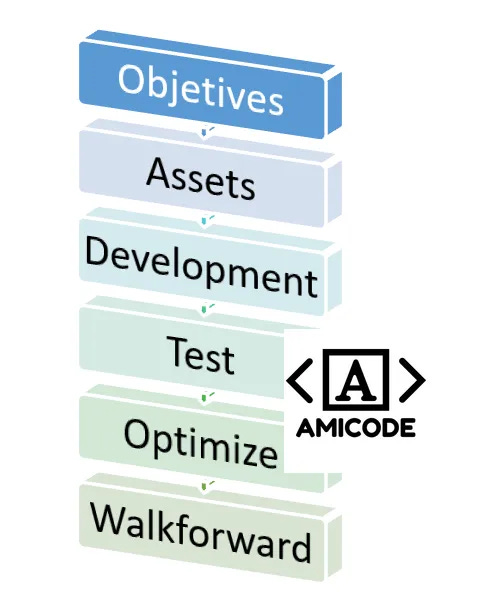

Split your historical dataset into at least two parts: one for development and one for validation.

If possible, add a third set of data for final testing (out-of-sample).

Test the strategy across different market cycles (bullish, bearish, sideways).

6. Using an Insufficient Sample Size

A strategy based on a small number of trades may look promising, but it lacks statistical reliability. For example, a sample of 20 or 30 trades cannot provide solid evidence of long-term profitability.

Additionally, small sample sizes are easily skewed by unusual market events that are unlikely to repeat.

How to avoid it:

Aim for at least 100 trades in your backtest to ensure statistical strength.

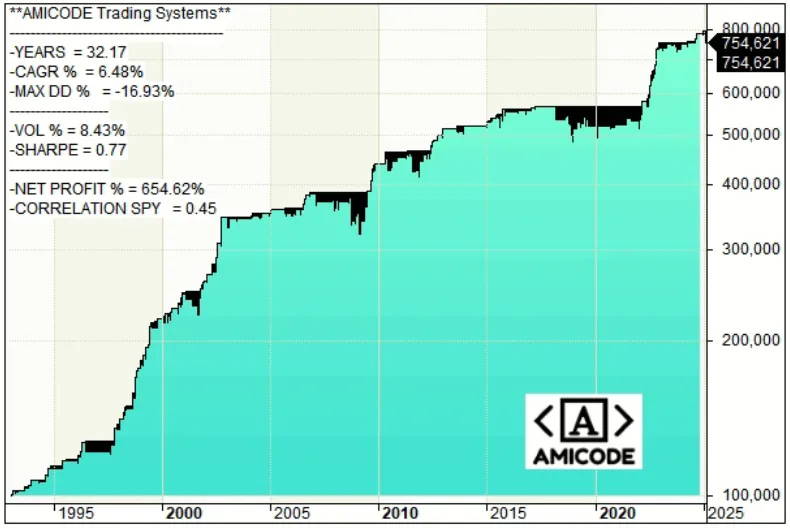

Include several years of data that reflect different market conditions.

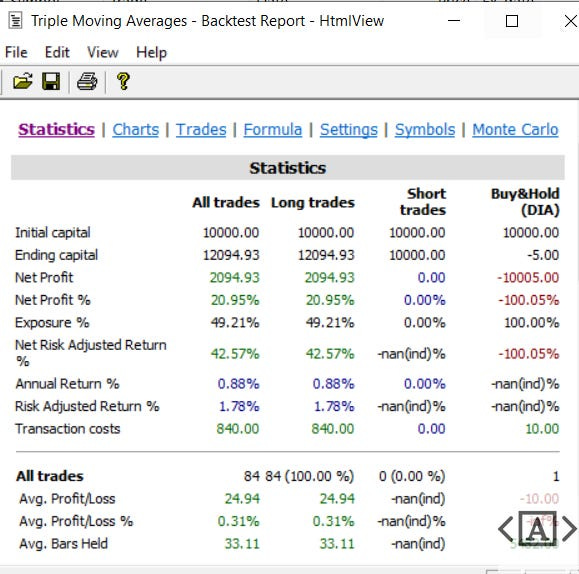

Look beyond net profit—analyze consistency, drawdowns, win/loss ratios, and other key metrics.

7. Not Simulating Real Trading Conditions

One of the most overlooked mistakes in backtesting is failing to replicate real-world trading conditions. Traders often assume perfect execution: being available for every signal, reacting immediately, and always making the right decision.

Reality, however, is far from perfect. Mental stress, discipline, reaction time, and scheduling all play a role—especially with manual systems. If the strategy requires fast execution and constant monitoring, it might not be feasible without the right tools.

How to avoid it:

Simulate your trades as if you were operating in live conditions.

If the system is manual, ensure it fits your daily schedule and trading discipline.

Use demo accounts or advanced simulators before committing to real capital.

Conclusion

Backtesting is a powerful ally when building effective trading strategies, but only if done correctly. Avoiding mistakes like overfitting, using poor data, or ignoring liquidity is essential to ensure that your results are both realistic and actionable.

Pay attention to asset quality, market liquidity, sample size, and how you interpret historical data. By doing so, you’ll be able to create more reliable, robust, and sustainable systems for the long term.

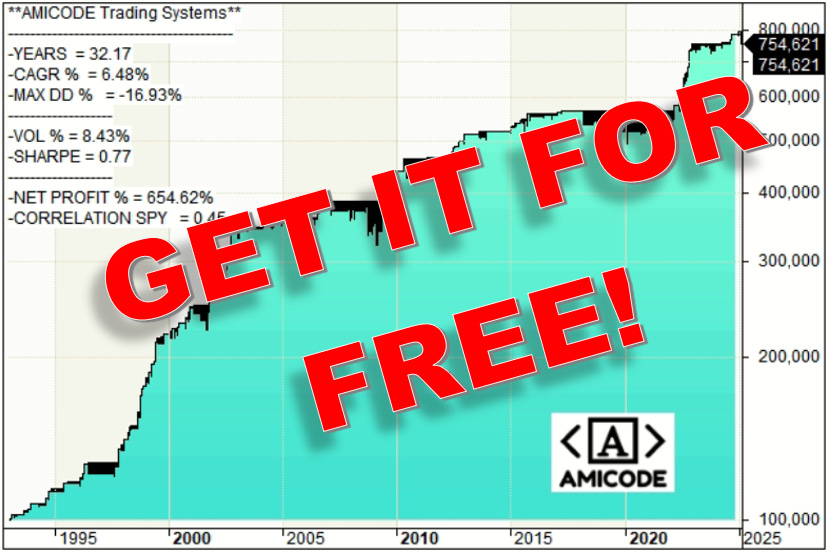

Do you want a Free AMICODE Trading Strategy?

Would you like to know what AMICODE Trading Strategies are like?

Disclaimer:

The content provided is for informational purposes only and should not be construed as financial advice. All information is provided "as is" with no representations or warranties, express or implied. The opinions expressed here are based solely on personal research and experience. Investing in the financial markets involves risks, including possible loss of principal. The systems provided on this website are made for educational and research purposes only, may contain errors and we make no guarantee of their accuracy. It is recommended not to trade these systems. We urge our readers to do their own research or consult with a qualified financial professional before making any investment decisions.

If you like our work, please share and give a like to get more. Thank you very much!