Introduction to Backtesting in Amibroker

Do your first backtest! Simple trading system code included.

The Importance of Backtesting in Trading

Backtesting is vital for any serious trader aiming to evaluate the effectiveness of their trading strategies before applying them in the actual market. This technique allows traders to test their strategies with historical data, identifying potential weaknesses and adapting them to maximize performance across various market scenarios.

Amibroker's Key Features for Backtesting

Amibroker stands out for its ability to facilitate effective backtesting through features such as:

Historical Data Testing: Allows strategies to be applied over several years of market data to verify their effectiveness over time.

Robust Optimization Tools: Adjust trading parameters to improve outcomes.

Portfolio Testing: Evaluate strategies across multiple stocks or markets simultaneously.

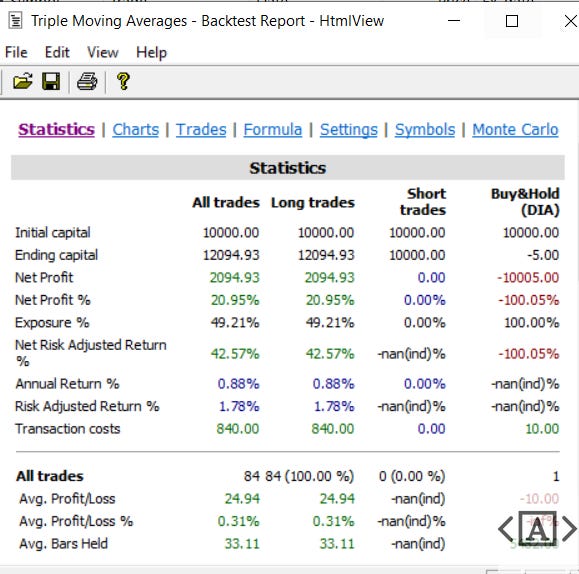

Detailed Reports: Provide performance metrics like profit factors, maximum drawdowns, and win rates.

Steps for Backtesting

Strategy Creation or Loading: Begin by developing or loading a strategy using AFL. Clearly define the buying and selling conditions.

Time Frame Selection: Choose the range of historical data you want to examine.

Backtest Execution: Use Amibroker's backtesting engine to run your strategy on the selected data.

Results Analysis: Review performance metrics to determine the viability of the strategy for live operations.

Strategy Optimization: Make adjustments to the parameters and run multiple backtests to find the best configuration.

Simple Moving Averages Backtest Code

As you can see below, it is extremely simple to test ideas coded in Amibroker's AFL. You should not rely on what is said here and there when you can test it yourself in just a few lines of code. What assets will it work on? Try it out and check the report.

//** Simple Moving Averages Test- MA20 and MA100

// Indicators

MA20 = MA(C,20);

MA100 = MA(C,100);

// Buy and Sell Signals

Buy = Cross(MA20,MA100);

BuyPrice= Close;

sell = Cross(MA50,MA100);

SellPrice= Close;

Report Metrics to Check

When analyzing backtest results, it is crucial to pay attention to specific metrics that indicate the robustness and reliability of a strategy, such as:

Profit Factor: The ratio between gross profits and gross losses. A factor above 1.5 is generally considered good.

Maximum Drawdown: The largest drop in portfolio value between two consecutive peaks. It is crucial for risk management.

Recovery Factor - Net profit divided by Max. system drawdown

Winning Percentage: Indicates how often operations are successful.

Sharpe Ratio: Measures risk-adjusted return. The higher, the better.

Conclusion: Is Your Strategy Ready for the Markets?

Backtesting with Amibroker is a powerful tool for assessing the viability of a trading system before risking real capital. Although it provides valuable insights, it is essential to remember that it is not infallible. Market conditions change, and a strategy that worked in the past may not be effective in the future.

It's simply imprudent to operate any strategy without first thoroughly testing it to understand its potential in various conditions. Nonetheless, proper backtesting can significantly improve the chances of success in live markets.