Amibroker: The Ideal Platform for Developing Trading Systems

Why should you use Amibroker?

Why should you use Amibroker?

AmiBroker has established itself as one of the most powerful and flexible tools for developing and testing algorithmic trading systems. Created in the 1990s by Tomasz Janeczko, AmiBroker has evolved into the preferred platform for traders and investors who seek to create and optimize automated strategies. Its flexibility, speed, and advanced backtesting capabilities make it ideal for those operating in financial markets using automated systems.

AmiBroker’s History

AmiBroker started as a simple tool for chart and technical analysis, but its real breakthrough came with the introduction of the AmiBroker Formula Language (AFL), a programming language that allows users to design highly customized automated trading systems. This focus on customization and automation has been key to its growth and adoption in the algorithmic trading community.

Key Advantages of AmiBroker for Trading Systems Development

Flexibility with AmiBroker Formula Language (AFL) One of AmiBroker's core strengths is its proprietary programming language, AFL, which allows traders to create, test, and automate trading systems. AFL is accessible enough for users with little programming experience but powerful enough to develop complex strategies. This provides traders with unprecedented flexibility to implement any trading idea into automated rules.

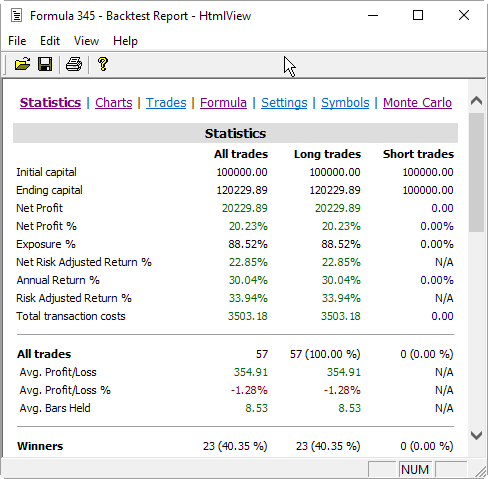

Advanced and Fast Backtesting AmiBroker excels in its backtesting capabilities, allowing traders to test their trading strategies on historical data at extremely high speeds. This is critical for trading systems as it helps verify how a strategy would have performed under different market conditions. AmiBroker offers accurate simulation, taking into account transaction costs, slippage, and other real market variables, ensuring that backtest results are as realistic as possible.

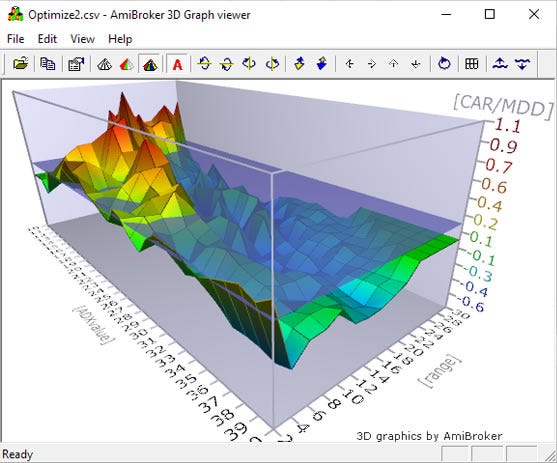

System Optimization AmiBroker includes advanced optimization tools to fine-tune trading system parameters. The platform allows comprehensive optimization to find the best parameter combinations to maximize system performance. It also includes sensitivity analysis, helping traders understand how small changes in parameters can affect overall strategy performance.

Full Trading Automation AmiBroker allows complete automation of the trading process. Once a trading system has been developed and optimized, it can be executed automatically using compatible brokers. This means traders can implement algorithmic strategies without manual intervention, ideal for those looking to execute trading systems based on clear and objective rules.

Support for Multi-Asset Strategies AmiBroker supports multiple asset types such as stocks, futures, options, and currencies, enabling traders to develop trading systems across different markets. This is crucial for traders who want to diversify their strategies or apply a multi-asset approach to algorithmic trading.

Monte Carlo and Walk Forward Optimization Two advanced features AmiBroker offers for improving trading systems are Monte Carlo analysis and Walk Forward testing. Monte Carlo analysis helps evaluate the robustness of a strategy through random simulations, while Walk Forward testing evaluates how a strategy will perform in the future by applying optimization to only a portion of the historical data and then testing it on non-optimized data.

Common Applications of AmiBroker in Trading Systems

Strategy Development and Automation: AmiBroker allows traders to build rules based on technical indicators, price patterns, volume, and other factors and convert them into fully automated strategies.

Backtesting and Simulations: AmiBroker enables simulations using historical data to assess a trading system’s potential profitability under different market conditions, helping traders avoid common mistakes in live environments.

Parameter Optimization: Traders can fine-tune their system parameters to achieve the best possible results using AmiBroker’s optimization and sensitivity analysis tools.

Conclusion

AmiBroker is an indispensable tool for any trader looking to develop, test, and automate algorithmic trading systems. Its fast backtesting engine, AFL’s flexibility, and advanced optimization tools make it one of the best options available for professional and algorithmic traders. Its ability to adapt to a wide variety of assets and its ease in automating processes are key factors positioning it as a leading platform for trading system development.